Interest Rate (Jump Rate Model)

Jump Rate Model

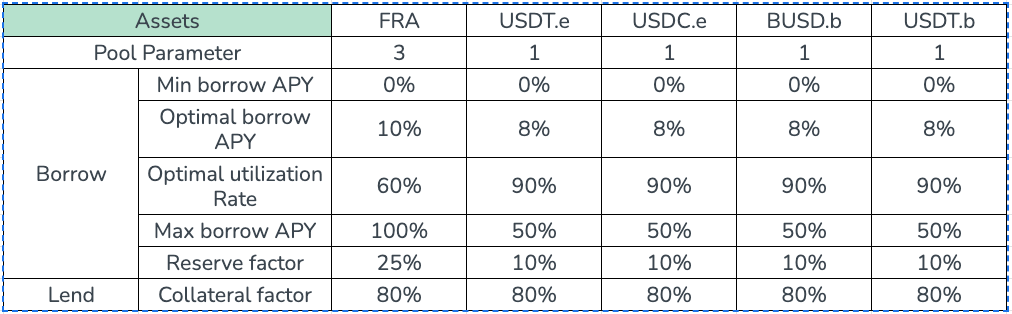

Forlend features a dynamic interest rate model. Interest rate on each market is different and is calculated based on the Current Utilization of a given market (how much of the supplied liquidity is borrowed v.s. available). Forlend's interest model follows Compound Protocol's Jump Rate model.

When the

Current Utilizationrate increases, both the borrowing rate and supply rate will increase.When

Current Utilizationis lower thanTarget Utilization(the kink point), the borrowing rate will increase at a lower rate linearly.When

Current Utilizationis overTarget Utilization(the kink point), the borrowing rate will increase at a higher rate linearly.Each "Market" has its own interest rate based on Market Parameters and

Current Utilizationrates.

supplyRate = borrowRate * (1- reserveFactor) * utilizationRate

when currentUtilization <= targetUtilization:

borrowRate = baseRate + utilizationRate * multiplier

when currentUtilization > targetUtilization:

borrowRate = baseRate +utilizationRate * multiplier + (utilizationRate - targetUtilization)*jumpMultiplier

V1 Deployment

👇 Example Interest Rate Chat

Lending Protocol

borrow% at 0%

borrow% at K

borrow% at 100%

Kink

reserver%

0.00 %

10.00 %

100.00 %

60.00 %

25.00 %

Contructor

blocksPerYear

baseRatePerYear

multiplierPerYear

jumpMultiplierPerYear

kink_

1971000

0

100000000000000000

2250000000000000000

600000000000000000

Property

baseRatePerBlock

multiplierPerBlock

jumpMultiplierPerBlock

kink

reserve

0

84559445290

1141552511416

600000000000000000

250000000000000000

Utilization %

Borrow %

Supply %

util

b% per block

s% per block

0.00 %

0.0000 %

0.0000 %

0

0

0

1.00 %

0.1667 %

0.0012 %

1E+16

845594452.9

6341958.397

2.00 %

0.3333 %

0.0050 %

2E+16

1691188906

25367833.59

3.00 %

0.5000 %

0.0112 %

3E+16

2536783359

57077625.57

4.00 %

0.6667 %

0.0200 %

4E+16

3382377812

101471334.3

5.00 %

0.8333 %

0.0312 %

5E+16

4227972265

158548959.9

6.00 %

1.0000 %

0.0450 %

6E+16

5073566717

228310502.3

7.00 %

1.1667 %

0.0612 %

7E+16

5919161170

310755961.4

8.00 %

1.3333 %

0.0800 %

8E+16

6764755623

405885337.4

9.00 %

1.5000 %

0.1012 %

9E+16

7610350076

513698630.1

10.00 %

1.6667 %

0.1250 %

1E+17

8455944529

634195839.7

11.00 %

1.8333 %

0.1512 %

1.1E+17

9301538982

767376966

12.00 %

2.0000 %

0.1800 %

1.2E+17

10147133435

913242009.1

13.00 %

2.1667 %

0.2112 %

1.3E+17

10992727888

1071790969

14.00 %

2.3333 %

0.2450 %

1.4E+17

11838322341

1243023846

15.00 %

2.5000 %

0.2812 %

1.5E+17

12683916794

1426940639

16.00 %

2.6667 %

0.3200 %

1.6E+17

13529511246

1623541350

17.00 %

2.8333 %

0.3612 %

1.7E+17

14375105699

1832825977

18.00 %

3.0000 %

0.4050 %

1.8E+17

15220700152

2054794521

19.00 %

3.1667 %

0.4512 %

1.9E+17

16066294605

2289446981

20.00 %

3.3333 %

0.5000 %

2E+17

16911889058

2536783359

21.00 %

3.5000 %

0.5512 %

2.1E+17

17757483511

2796803653

22.00 %

3.6667 %

0.6050 %

2.2E+17

18603077964

3069507864

23.00 %

3.8333 %

0.6612 %

2.3E+17

19448672417

3354895992

24.00 %

4.0000 %

0.7200 %

2.4E+17

20294266870

3652968037

Last updated